Car depreciation calculator tax deduction

Under the luxury car rules the actual bonus deduction for the year is limited to the first-year cap eg 19200 for a vehicle placed in service in 2022. The MACRS Depreciation Calculator uses the following basic formula.

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

The calculator makes this calculation of course Asset Being Depreciated -.

. SLD is easy to calculate because it simply takes the. Prime Cost Method for Calculating Car Depreciation. To calculate the depreciation of your car you can use two different types of formulas.

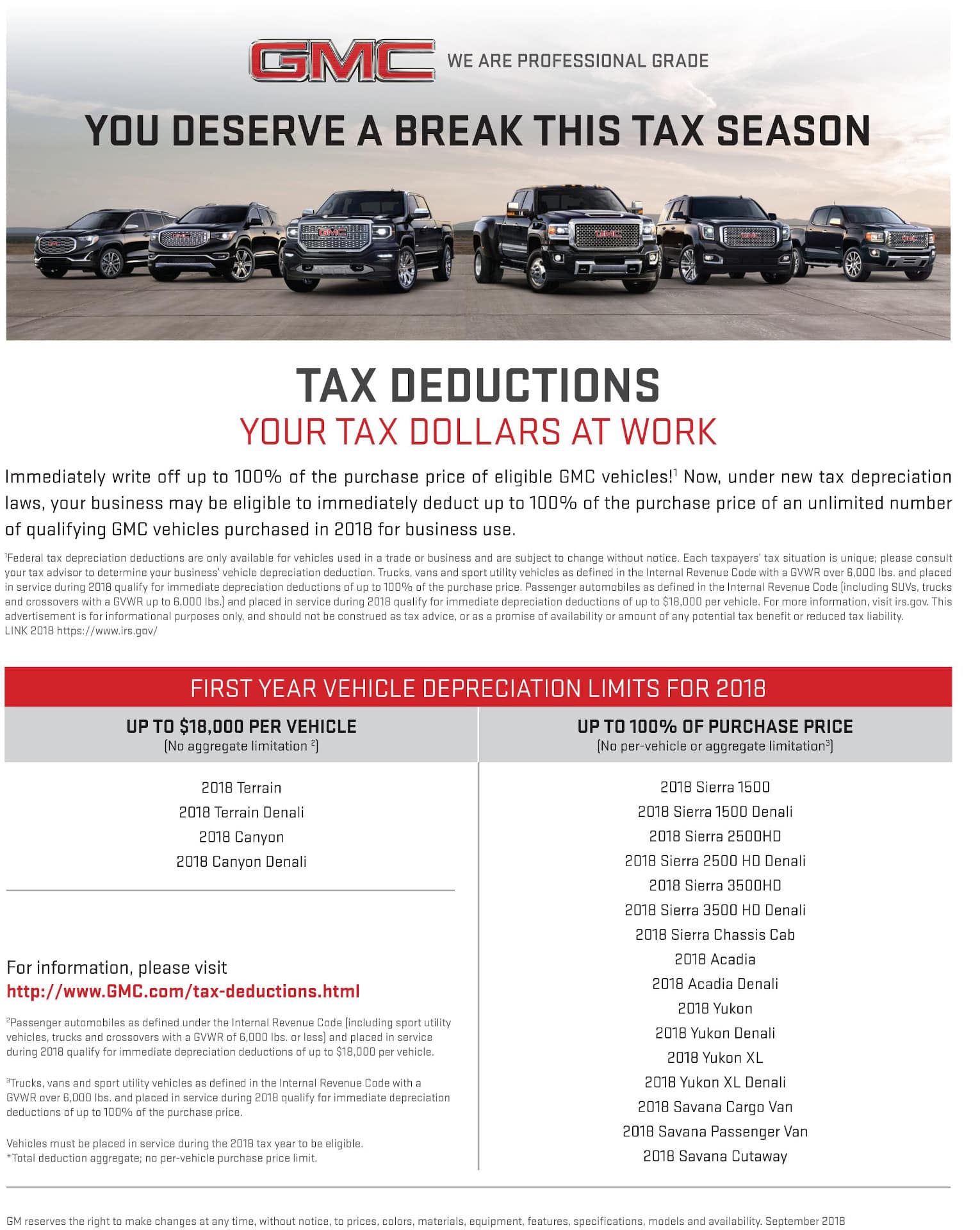

18100 First-Year Depreciation for Qualifying Models In 2022 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. 2 lieu dit Vallières 37360 Neuillé Pont Pierre.

Use this depreciation calculator to forecast the value loss for a new or used car. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. You must not have claimed a depreciation deduction for the car using any method other.

Cost of Running the Car x Days you owned 365 x. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. You use the car for business purposes 75 of the.

Can you calculate a tax deduction for vehicle depreciation. Depreciation follows a general formula using either the prime cost method or the diminishing. Note that this method.

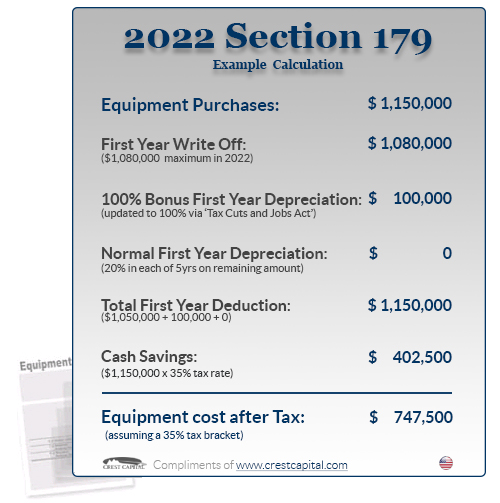

By entering a few details such as price vehicle age and usage and time of your ownership we use. Individual Tax Return Form 1040 Instructions. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the.

For instance a widget-making machine is said to depreciate. It can be used for the 201314 to 202122 income. Instructions for Form 1040 Form W-9.

Car depreciation calculator tax deduction Friday September 16 2022 66 cents per kilometre for the 201718 201617 and 201516. This is because car depreciation chips away at the. C is the original purchase price or basis of an asset.

Depreciation of most cars based on ATO estimates of useful life is. So if you purchased a car for 30000 and you want to know how much your new car will depreciate after five years here is how you would calculate the value based on the above. Equal expensing each year so if you spent 30000 on your car on January 1st divided evenly over 5 years you would get a 6000 deduction per year.

This depreciation calculator is for calculating the depreciation schedule of an asset. D i C R i. Par exemple supposons que votre.

It spreads the cost evenly and allows you to deduct 20 of the cars cost every year. The deduction limit in 2021 is 1050000. Car depreciation or the loss of value on your vehicle over time will affect the overall financial impact of your buying decision.

7 For example lets say you spent 20000 on a new car for your business in June 2021. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. La dépréciation de la valeur comptable des actifs plus anciens les affecte une valeur plus réaliste que si vous ne déclariez que le prix dachat dorigine.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. It can be used for the 201314 to 202122 income years. Raiffeisen bank international ag investor relations.

06 11 25 86 05 Mail. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Where Di is the depreciation in year i.

In other words you can deduct 20 of 16000 or 3200 from your taxable income each of. We will even custom tailor the results based upon just a few of.

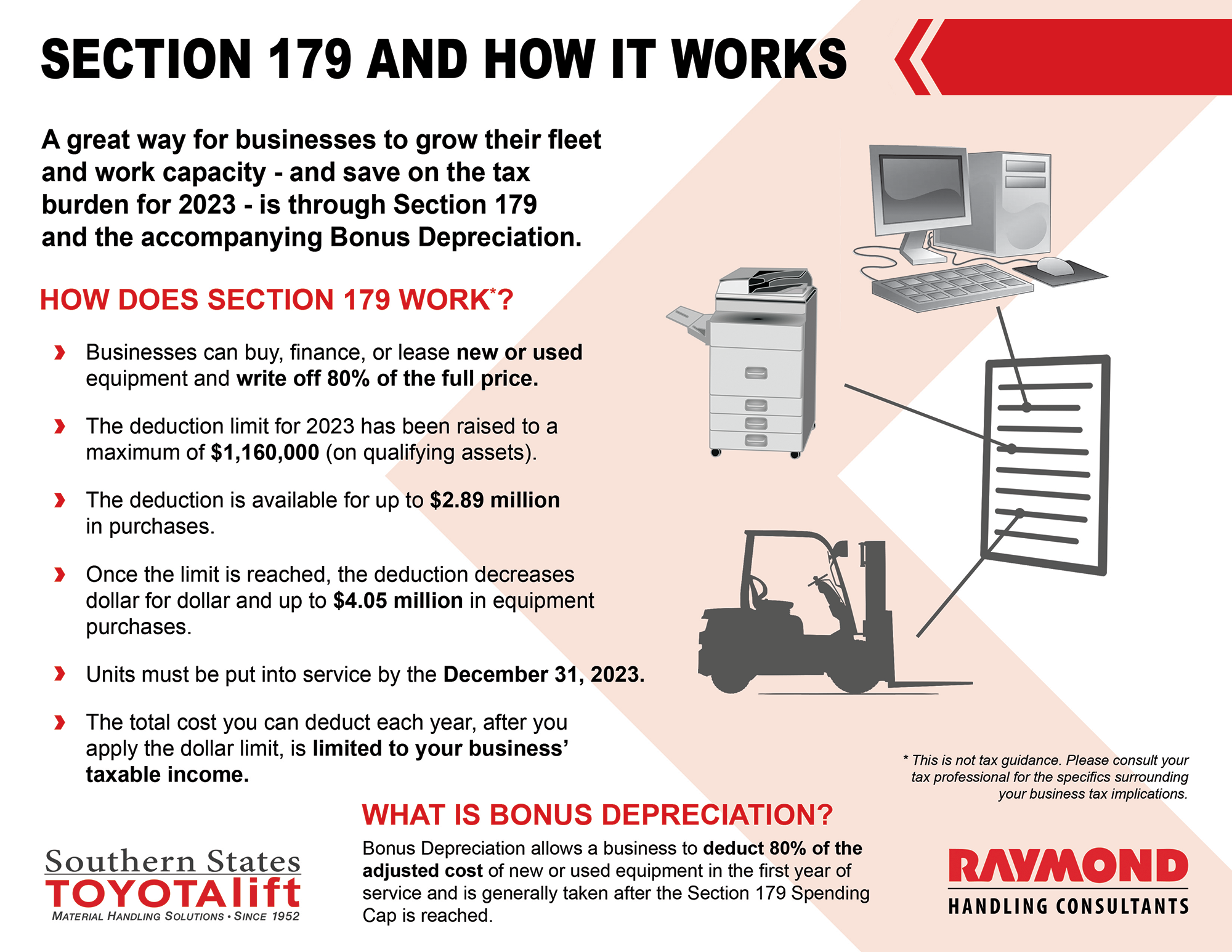

Section 179 Deduction Hondru Ford Of Manheim

Is Buying A Car Tax Deductible In 2022

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

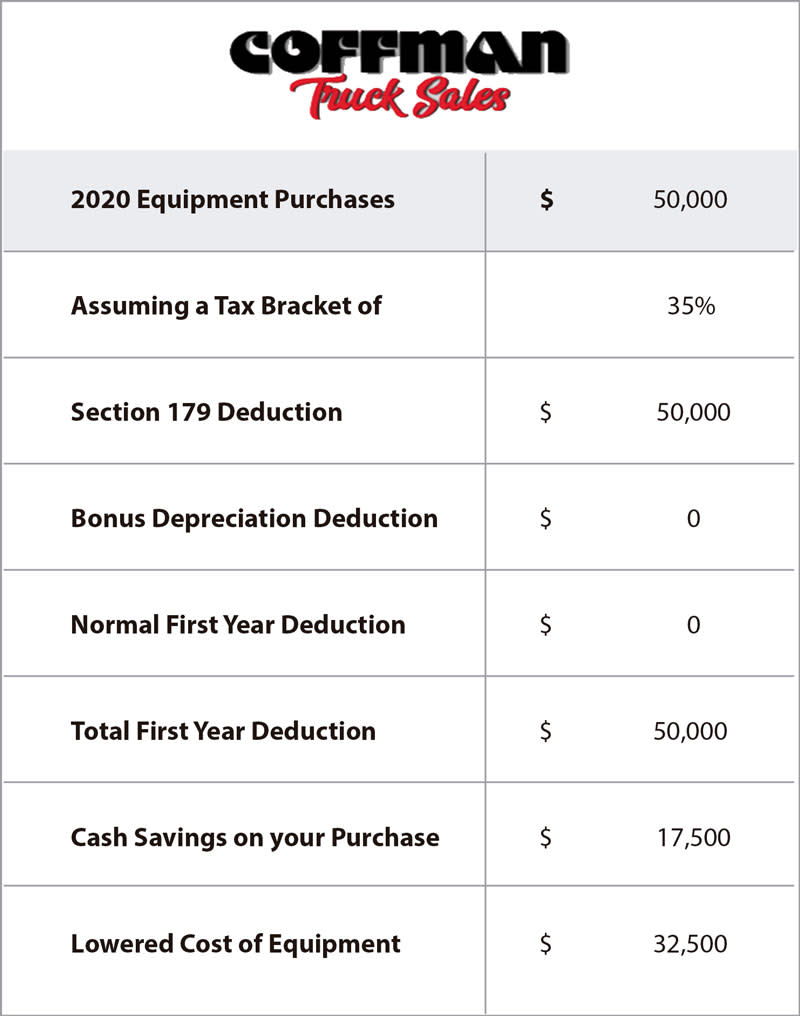

Section 179 Tax Deduction Coffman Truck Sales

Is Buying A Car Tax Deductible In 2022

Is Buying A Car Tax Deductible In 2022

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

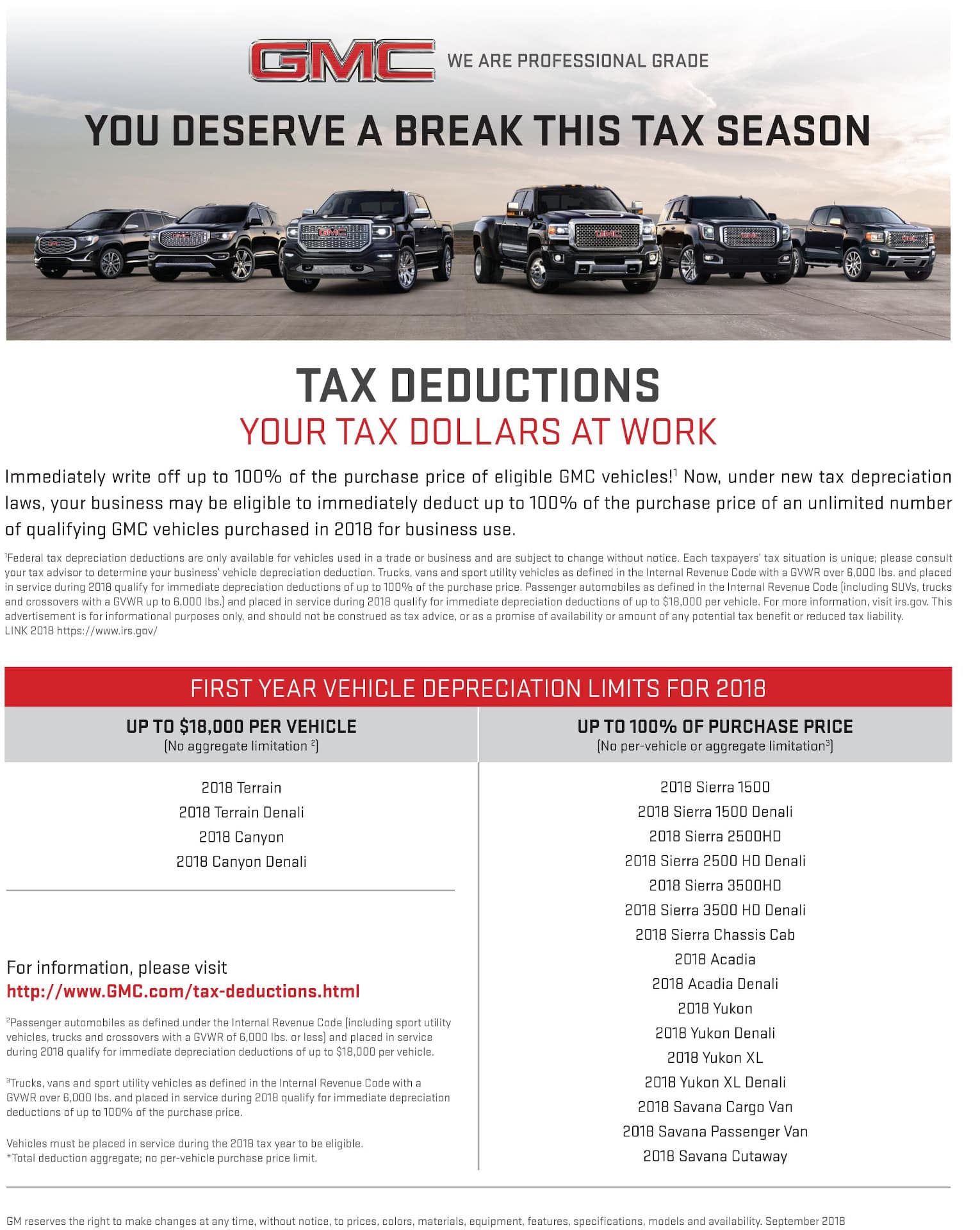

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

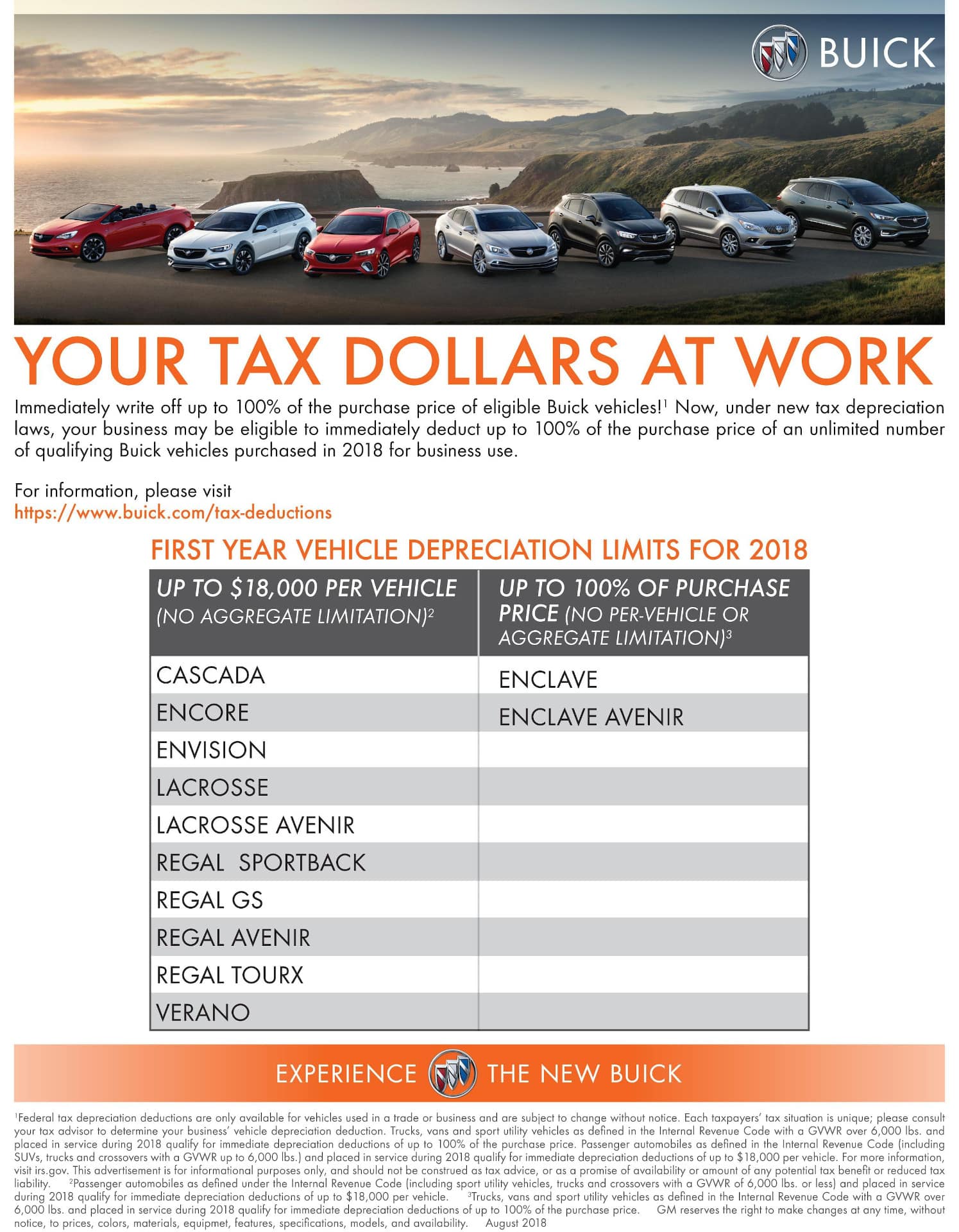

Year End Tax Deduction Heyward Allen Motor Company Inc

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Section 179 Small Business Tax Deduction Universal Nissan

Pin On Mission Organization

4f7swm0ftjetsm

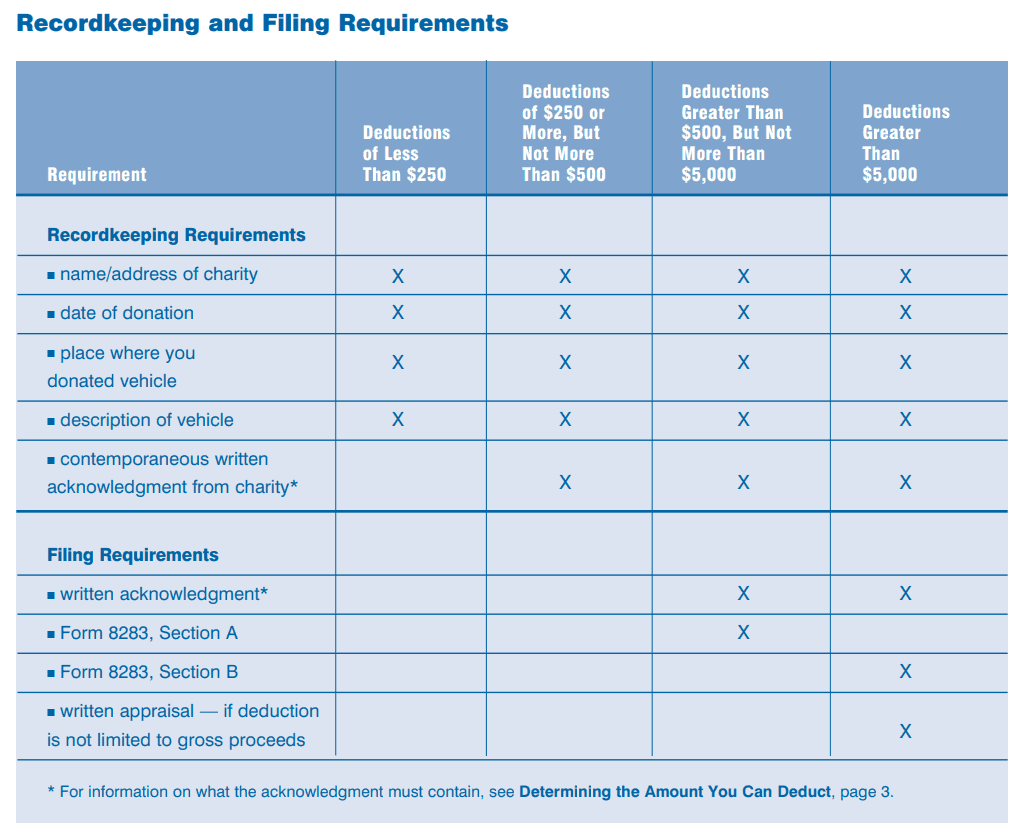

2022 Car Donation Tax Deduction Information

Year End Tax Deduction Heyward Allen Motor Company Inc

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos